Hi

http://colorshipping.com/industry.php?dan=1ev3b701kgbz

drhkennebunk@yahoo.com

drhkennebunk

Maine Investor

Wednesday, April 6, 2016

Wednesday, June 19, 2013

Thursday, October 4, 2012

http://myemail.constantcontact.com/HM-Payson-Research-Note---Not-All-Dividends-Are-Created-Equal.html?soid=1108300139327&aid=6YNemu9qEGI

Attached is an analysis concluding that investors need to be far more discriminate when considering dividend-paying stocks for their high yields: above the 3% threshold, in particular, small increments of higher dividend yield beget much more additional risk than return.

http://myemail.constantcontact.com/HM-Payson-Research-Note---Not-All-Dividends-Are-Created-Equal.html?soid=1108300139327&aid=6YNemu9qEGI

http://myemail.constantcontact.com/HM-Payson-Research-Note---Not-All-Dividends-Are-Created-Equal.html?soid=1108300139327&aid=6YNemu9qEGI

Wednesday, August 22, 2012

Microsoft: Left in the Dust - and Brimming with Value

| |

|

Friday, August 3, 2012

Europe: Uncertainty and Opportunity

The sovereign debt crisis in Europe and subsequent worldwide economic slowdown has been the top news story and at the forefront of many investors’ minds for nearly 3 years. Fiscal austerity, likely restructuring of the debt of the peripheral sovereigns, and a reluctance to implement needed structural reforms within the European Union (namely, more centralized control of member country finances) will present a persistent headwind to global economic growth. Yet, in this environment of uncertainty and pessimism, we believe there are excellent investment opportunities; one simply needs to dig a little deeper to unearth them.

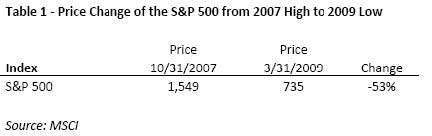

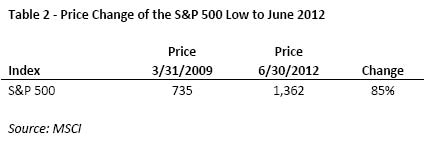

In March 2009 the economic outlook looked grim for the United States. The bursting of the housing bubble and melt down in the mortgage market engendered a massive liquidity crunch that froze credit markets. Economic activity fell precipitously; and with so much bad debt in the system, it was hard to imagine business activity wouldn’t continue to deteriorate – never mind see improvement. And yet, as Table 2 illustrates, an investment in the S&P 500 in March 2009 provided a return of 85% (price only) through June of this year. Historic rallies are born in the depths of crises.

A specific example of a European stock that we have liked for several years now is Diageo. It has provided excellent returns since the beginnings of the Greek crisis in October of 2009. As Chart 1 shows Diageo (Ticker: DEO) has provided a total return of almost 72% since October 30, 2009, far exceeding the MSCI Euro Index total return of -1.9%. At the time we found the valuation of the shares of this high-quality company very attractive: the cash flow yield was 8.5%, the earnings yield was over 7%, and the dividend yield approached 4%. This is a perfect example of a great company with attractive yields providing a wonderful investment opportunity in a horrible economic environment.

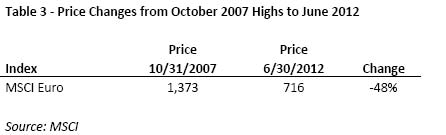

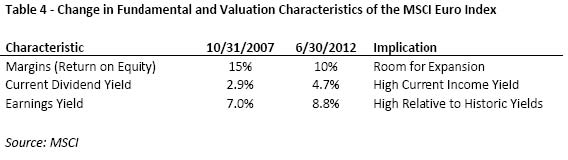

Looking forward, the MSCI Euro Index looks attractive to us. Table 4 compares where the MSCI Euro Index was in October 2007 and where it is today. Good relative investment returns might come from eventual margin expansion, and the index’s high current earnings and dividend yields.

We are also finding companies with healthy businesses (using the discounted cash flow models in a method described in detail in our last Research Note, “Healthcare Stocks: Attractively Valued No Matter What Happens in Washington”- July 10, 2012), that are priced as if they are in permanent decline. Two examples that fit this description are in Table 5.

Tuesday, July 10, 2012

Heathcare Stocks Attractively Priced

We’ll leave the legal analysis of the recent Supreme Court rulings regarding the Affordable Healthcare Act to the pundits on the network news. Our priority is to preserve and grow our clients’ financial assets. In that vein, we continue to find attractive investment values in high quality healthcare companies. Relative to most other opportunities, we believe these investments will perform well whatever form healthcare reform ultimately takes.

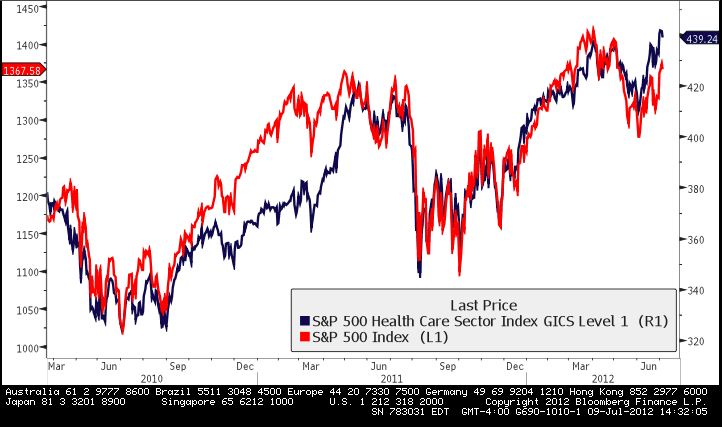

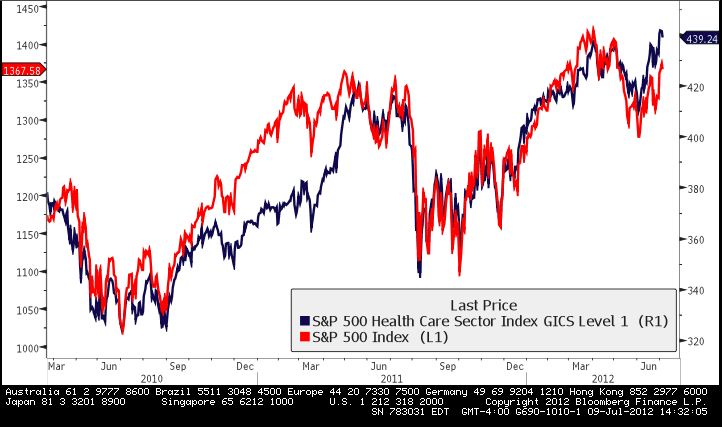

The chart below compares the S&P Healthcare Index (the dark blue line, which consists of the largest 52 US healthcare companies) and the S&P 500 (the red line, the most widely used proxy for the US stock market). The date range is from March 23, 2010 – the day President Obama signed the Affordable Healthcare Act into law – and the current date (July 5, 2012).

The chart shows – perhaps surprisingly – that healthcare companies as a group have performed almost exactly in line with the S&P 500. Moreover, on the day of the historic Supreme Court ruling supporting the individual insurance mandate, the healthcare index responded with a big yawn, and performed in line with the overall market. This suggests to us the potential negative impacts of the Affordable Healthcare Act had been priced into healthcare stocks for some time.

The chart shows – perhaps surprisingly – that healthcare companies as a group have performed almost exactly in line with the S&P 500. Moreover, on the day of the historic Supreme Court ruling supporting the individual insurance mandate, the healthcare index responded with a big yawn, and performed in line with the overall market. This suggests to us the potential negative impacts of the Affordable Healthcare Act had been priced into healthcare stocks for some time.

The chart below compares the S&P Healthcare Index (the dark blue line, which consists of the largest 52 US healthcare companies) and the S&P 500 (the red line, the most widely used proxy for the US stock market). The date range is from March 23, 2010 – the day President Obama signed the Affordable Healthcare Act into law – and the current date (July 5, 2012).

The chart shows – perhaps surprisingly – that healthcare companies as a group have performed almost exactly in line with the S&P 500. Moreover, on the day of the historic Supreme Court ruling supporting the individual insurance mandate, the healthcare index responded with a big yawn, and performed in line with the overall market. This suggests to us the potential negative impacts of the Affordable Healthcare Act had been priced into healthcare stocks for some time.

The chart shows – perhaps surprisingly – that healthcare companies as a group have performed almost exactly in line with the S&P 500. Moreover, on the day of the historic Supreme Court ruling supporting the individual insurance mandate, the healthcare index responded with a big yawn, and performed in line with the overall market. This suggests to us the potential negative impacts of the Affordable Healthcare Act had been priced into healthcare stocks for some time.

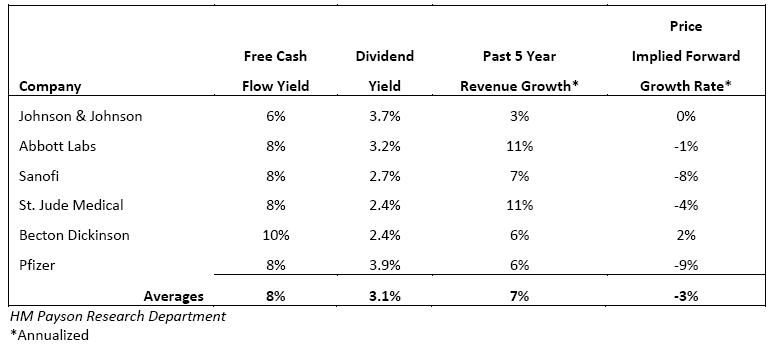

The table below is a sample of companies we currently find attractive. As the first two columns show, these companies boast an average free cash flow yield of 8% and an average dividend yield of 3.1%. – which compares very favorably to the 10 year treasury yield of 1.6%.

The last column tells the most interesting story from an investing standpoint but it requires an explanation. The “Price-Implied Forward Growth Rate” represents the future growth rate required to support the current price of each company based upon several simple assumptions and inputs we use to calculate this. We solve a “growth equation” for the future growth rate implied from today’s stock price[1]. This contrasts with the conventional way of applying this equation in which an analyst uses a projected growth rate to solve for a target price (a method commonly used by Wall Street analysts).

By solving for the growth rate instead of attempting to predict it, we can better understand the market assumptions underlying the price and begin to identify the better relative values. As shown in the table, the current prices of the six companies imply that revenues will decline 3% annually, in perpetuity. This seems too pessimistic to us.

Even in an environment of more regulation and less price inflation, healthcare companies will probably experience some growth from new products, aging populations in developed countries, global population growth, and increased exports to emerging markets. Furthermore, the companies mentioned have the cash flows and financial flexibility to enhance shareholder value with increased dividends and share repurchases.

In conclusion, as is so often the case in investing, market uncertainty can present opportunities to invest at lower prices. The ongoing healthcare reform debate is just the latest example. The shares of many quality healthcare companies offer generous yields and the potential for price appreciation as the uncertainty is eventually replaced by actual results. Therefore, we maintain a generous representation of healthcare stocks in our clients’ portfolios.

In conclusion, as is so often the case in investing, market uncertainty can present opportunities to invest at lower prices. The ongoing healthcare reform debate is just the latest example. The shares of many quality healthcare companies offer generous yields and the potential for price appreciation as the uncertainty is eventually replaced by actual results. Therefore, we maintain a generous representation of healthcare stocks in our clients’ portfolios.

[1] This calculation is based upon an equation, widely used in finance, known as the “Discounted Cash Flow Model.“

Subscribe to:

Posts (Atom)