| |

|

Wednesday, August 22, 2012

Microsoft: Left in the Dust - and Brimming with Value

Friday, August 3, 2012

Europe: Uncertainty and Opportunity

The sovereign debt crisis in Europe and subsequent worldwide economic slowdown has been the top news story and at the forefront of many investors’ minds for nearly 3 years. Fiscal austerity, likely restructuring of the debt of the peripheral sovereigns, and a reluctance to implement needed structural reforms within the European Union (namely, more centralized control of member country finances) will present a persistent headwind to global economic growth. Yet, in this environment of uncertainty and pessimism, we believe there are excellent investment opportunities; one simply needs to dig a little deeper to unearth them.

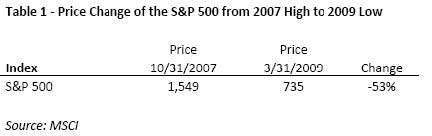

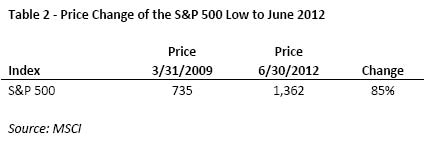

In March 2009 the economic outlook looked grim for the United States. The bursting of the housing bubble and melt down in the mortgage market engendered a massive liquidity crunch that froze credit markets. Economic activity fell precipitously; and with so much bad debt in the system, it was hard to imagine business activity wouldn’t continue to deteriorate – never mind see improvement. And yet, as Table 2 illustrates, an investment in the S&P 500 in March 2009 provided a return of 85% (price only) through June of this year. Historic rallies are born in the depths of crises.

A specific example of a European stock that we have liked for several years now is Diageo. It has provided excellent returns since the beginnings of the Greek crisis in October of 2009. As Chart 1 shows Diageo (Ticker: DEO) has provided a total return of almost 72% since October 30, 2009, far exceeding the MSCI Euro Index total return of -1.9%. At the time we found the valuation of the shares of this high-quality company very attractive: the cash flow yield was 8.5%, the earnings yield was over 7%, and the dividend yield approached 4%. This is a perfect example of a great company with attractive yields providing a wonderful investment opportunity in a horrible economic environment.

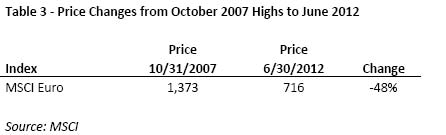

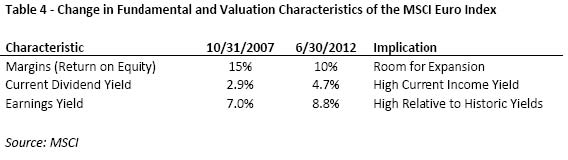

Looking forward, the MSCI Euro Index looks attractive to us. Table 4 compares where the MSCI Euro Index was in October 2007 and where it is today. Good relative investment returns might come from eventual margin expansion, and the index’s high current earnings and dividend yields.

We are also finding companies with healthy businesses (using the discounted cash flow models in a method described in detail in our last Research Note, “Healthcare Stocks: Attractively Valued No Matter What Happens in Washington”- July 10, 2012), that are priced as if they are in permanent decline. Two examples that fit this description are in Table 5.

Subscribe to:

Posts (Atom)